Table of Content

Hurricane Iniki, which hit in 1992 did so much damage that the majority of insurers excluded hurricane damage from their coverage. Homeowners in Hawaii now have to purchase a separate hurricane damage policy,” says Michael Barry, spokesman for the Insurance Information Institute. Insurance.com’s ranking provides an in-depth look at the best home insurance companies in 2022, based on a number of factors. Insurance.com ranked the major insurance companies for average price, J.D. With every type of insurance coverage, it's true that the cheapest policy isn't always the wisest choice. You want an insurance company that is financially healthy and that has a good reputation for service.

We analyzed prices in the 20 largest metropolitan areas in the U.S. to find the average homeowners insurance cost in each city. Meanwhile, Las Vegas was the cheapest city on the list, with an average annual rate of $1,018. The average homeowners insurance cost for $300,000 in dwelling coverage with $100,000 liability is $2,763. If you bump liability to the recommended amount of $300,000, homeowners insurance with dwelling coverage for a $300,000 house has a national average of $2,779.

Deductible amount

We changed the credit tier from “good” to “poor” as reported to the insurer to see rates for homeowners with poor credit. In states where credit isn’t taken into account, we only used rates for “good” credit. Using credit to set homeowners, renters, condo and mobile home insurance prices is not allowed in California, Maryland and Massachusetts.

Homeowners can ask friends and family for recommendations, shop around online, make phone calls, ask for quotes, and check the business records of companies they’re considering. The deductible on a policy is one of the few things that it is really possible to control when choosing a homeowners insurance policy. In other words, this is an opportunity to hedge saving money against the likelihood of making a claim in a given year. Aside from your home’s value, location is one of the most important factors to impact home insurance coverage and costs. This is because your particular location has a lot to do with how insurance companies calculate potential risks.

What is Guaranteed Replacement Cost Homeowners Insurance?

A home equity line of credit is a great safeguard, but when the home itself is lost, that’s no longer an option. Homeowners insurance is a fundamental, unambiguous need for homeowners. Homeowners may want to consider one of the best homeowners insurance companies like Lemonade or Allstate when shopping for a homeowners policy. Most mortgages are set up with an escrow account, which means that the mortgage company collects a portion of your home insurance premiums in your monthly payment. These amounts will be saved in your escrow account and the mortgage company will then pay your home insurance and property taxes when they come due.

Its average rates are an astounding 203% lower than the national average. States with frequent hurricanes, hailstorms, tornadoes and earthquakes tend to have higher home insurance rates. To get the best rates for your situation, shop around with at least three insurance companies. By comparing rates from multiple insurers, you can make sure you’re getting the best possible coverage at the lowest price. It’s likely no surprise that many of the most expensive ZIP codes for home insurance are in states that experience lots of severe weather.

Dwelling Coverage

It also covers attached and unattached structures on your property. The average cost of homeowners insurance in the U.S. is about $1,784 a year, but rates vary by state. The average annual rate for a home with $400,000 in dwelling coverage and $300,000 in liability and $1,000 deductible is about $3,231, according to a rate analysis by Insure.com. But rates vary significantly from state to state and from city to city. On average, home insurance costs about $231 per month, but the price depends on the coverage level.

These issues place a financial strain on insurance companies, which is causing many companies to pause business, pull out of the market or go insolvent. On average, the most expensive states for homeowners insurance in 2022 are Oklahoma, Nebraska and Kansas, while the least expensive states are Hawaii, Utah and Vermont. Mariah Posey is an auto and homeowners insurance writer and editor for Bankrate.com. She aims to make the insurance journey as convenient as possible by keeping the reader at the forefront of her mind in her work. Common payment options are monthly, quarterly, semiannually or annually. The average sales price of a new single-family home in the U.S. in 2020 was $391,900, according to the U.S.

Below is a look at how much an average home insurance policy might cost depending on the age of a home. Certain upgrades — such as updating an electrical or plumbing system — could lower homeowners insurance costs. Getting a new roof could also net you a discount, especially if it’s resistant to wind and/or hail.

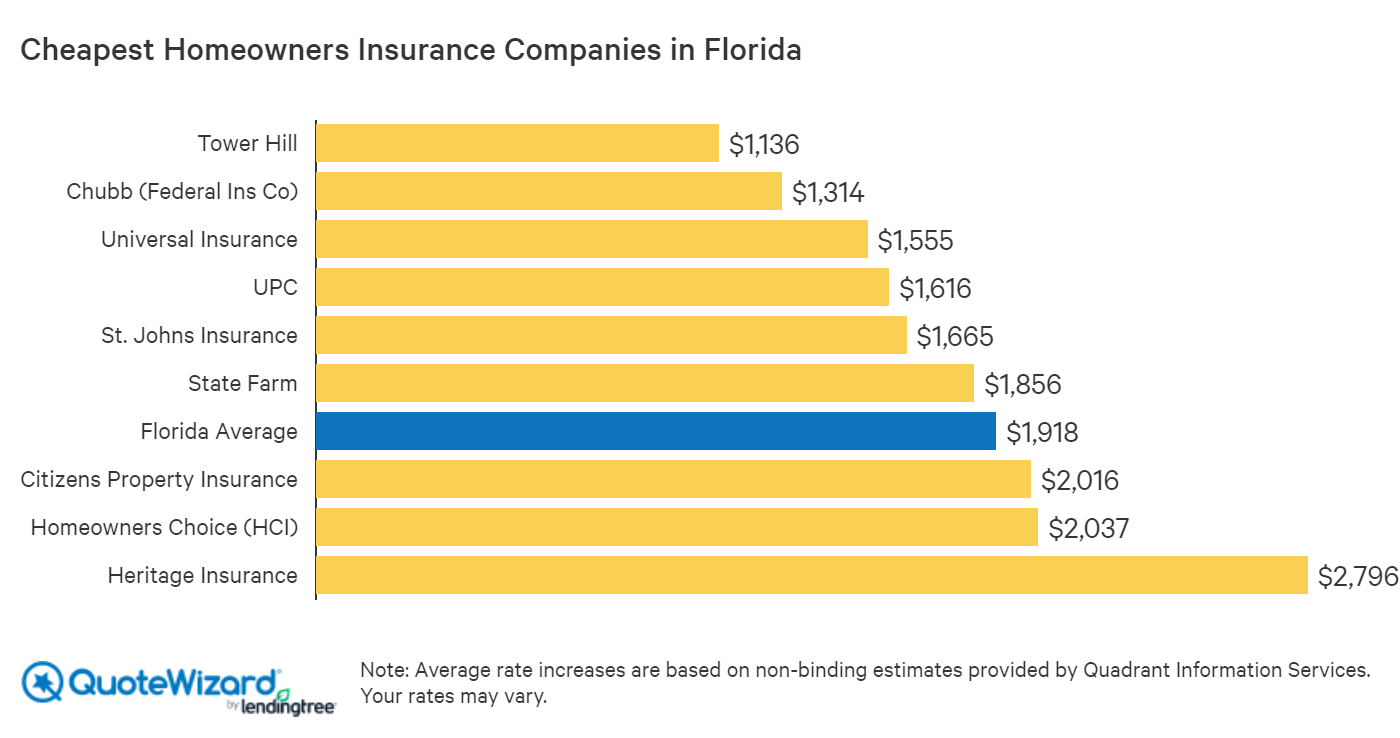

A higher dwelling coverage typically results in higher annual premium, but it’s still possible to find competitive premiums from different home insurance carriers. The proprietary rate data below highlights how your dwelling coverage limit could affect your average homeowners premium. Nationally, we found that Progressive has the cheapest home insurance premiums at $1,236 per year for $300,000 in dwelling coverage. But your rates will vary depending on the cost to rebuild your home, where you live, how much coverage you choose and other factors.

Coastal areas are more exposed to strong, damaging winds, and salt spray can cause steel and wood to age faster and fail sooner, so those risks also produce higher rates. All of these rates use a $1,000 deductible and $300,000 in liability. Getting home insurance discounts could be the easiest way to save money. Bankrate follows a stricteditorial policy, so you can trust that we’re putting your interests first. All of our content is authored byhighly qualified professionalsand edited bysubject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Here are the top-rated home insurance companies for 2022, based on Insurance.com’s analysis of average rates, J.D. What you pay for coverage depends on many factors, but one of the major variables is where you live. Our home insurance calculator lets you get a home insurance estimate for your ZIP code at various coverage levels.

Homeowners insurance costs an average of $1,784 a year, or about $149 a month, according to NerdWallet’s analysis. Kansas is part of the “Tornado Alley” — an area where destructive tornados are more likely to occur. Kansas had 68 tornados in 2022 and was ranked fifth in the country for such windstorms by The National Oceanic and Atmospheric Administration’s Storm Prediction Center.

No comments:

Post a Comment